Amazon Haul Takes on Temu and Shein

Noelle Voigt

To counter competition from platforms like Temu and Shein, which offer low-cost products with direct shipping from China, Amazon officially launched a new discount section: Amazon Haul. This move aims to retain customers by providing budget-friendly options as economic uncertainty drives consumers to seek more affordable products. Many items in the new section will also be shipped directly from Amazon’s Chinese warehouses to help keep prices low.

These changes will bring new obstacles for vendors and sellers, especially as they face tougher competition, shrinking margins, and evolving customer demands. In this article, we will explore these challenges and offer mitigation strategies to ensure (continued) success on Amazon.

The Rise of Temu and Shein

In recent years, two Chinese e-commerce platforms, Temu and Shein, have rapidly transformed the online shopping landscape, challenging major players like Amazon.

Amazon’s US app downloads have declined since their peak in 2022, as Temu and Shein have surged ahead, with Temu now consistently outperforming Amazon in weekly downloads.

Their direct-to-consumer models, combined with aggressive pricing and smart supply chain strategies, have enabled them to disrupt traditional retail and expand worldwide. Alongside AliExpress and TikTok Shop, these platforms drive China’s cross-border e-commerce boom. By delivering cheaper products and responding fast to new trends, they are actively seizing market share long dominated by Amazon.

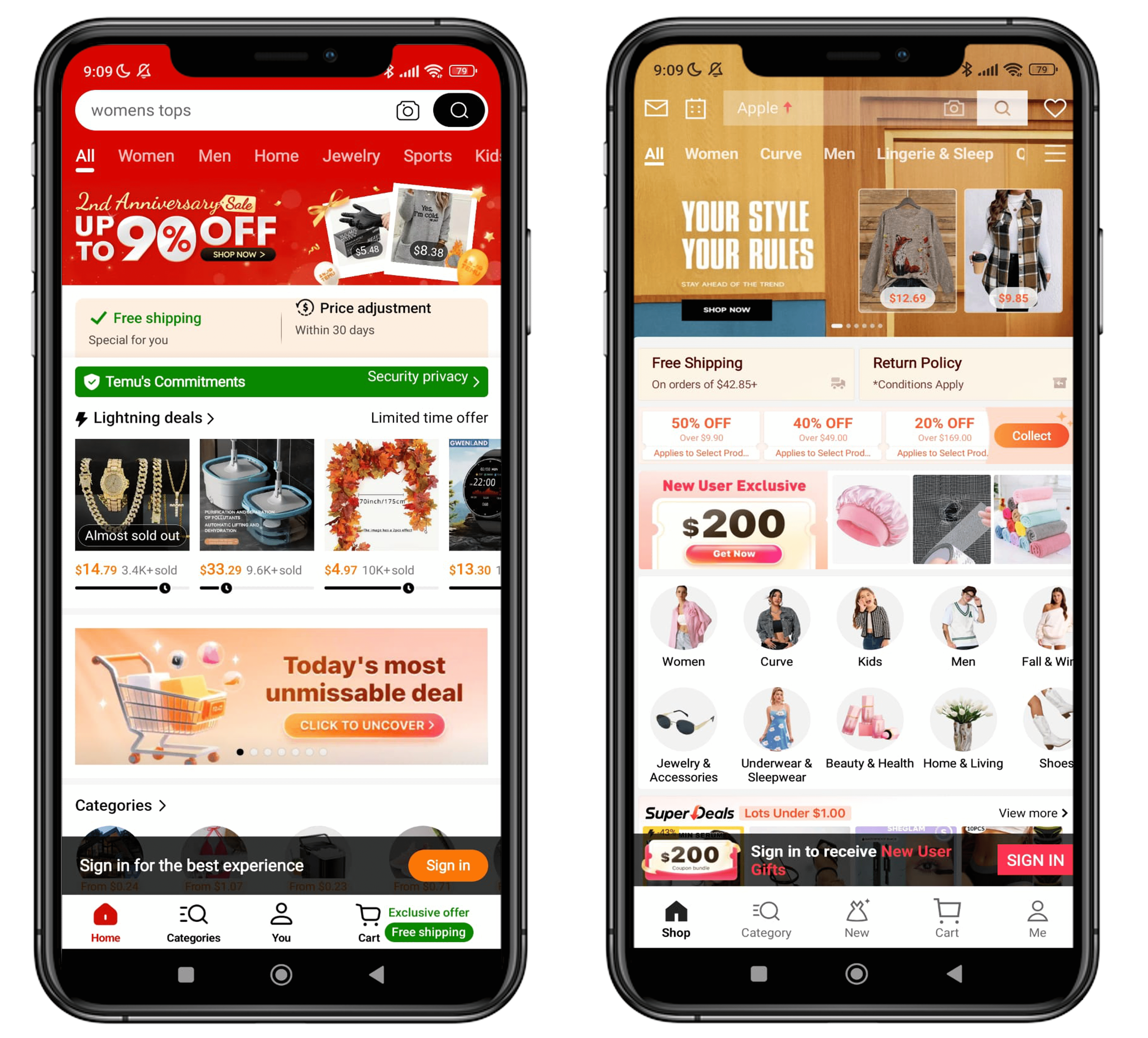

Shop like a Billionaire with Temu

Temu, launched in 2022, swiftly made its mark in Western e-commerce by offering a wide range of products, including clothing, electronics, and home goods, at extremely low prices. By sourcing directly from Chinese manufacturers, Temu can significantly undercut traditional retailers and competitors.

Temu’s heavily advertised “Shop Like a Billionaire” campaign taps into the desires of price-conscious shoppers, offering them the chance to indulge in more purchases thanks to the platform’s exceptionally low prices. This message has resonated strongly with consumers, helping Temu attract a large customer base worldwide.

By mid-2023, Temu reached $13 billion in sales, driven by its loss-leader model, where products are sold at deep discounts to attract and retain customers. Although this strategy allowed Temu to surpass competitors like Shein, it also led to significant financial losses, which are currently covered by its parent company, Pinduoduo. Despite these losses, Temu remains focused on expansion. Once Temu has secured a stable market position, it plans to become profitable by gradually increasing prices to match Shein’s.

Shein’s Ultra-Fast Fashion

Since its founding in 2008, Shein has dominated fast fashion, known for its rapid product turnover and low prices. With a focus on data-driven design, Shein adapts to emerging trends with speed and precision, producing ultra-fast fashion that resonates strongly with younger consumers.

This fashion-on-demand model allows Shein to consistently release new products and maintain a strong presence on social media platforms like TikTok, where the company seized 42% of the #haul tag across home and clothing products in 2023. However, such fast fashion practices have sparked heavy criticism due to their environmental impact.

Although Shein’s prices are low, they are generally higher than Temu’s and, most importantly, profitable for the company. By 2023, Shein was estimated to have generated over $30 billion in revenue. Besides competing with Temu, Shein is also taking on Amazon as it moves into product categories beyond fashion.

Social Media Meets Gamified Shopping

Temu and Shein have transformed e-commerce with effective social media marketing and influencer partnerships, using mobile-first strategies to create smooth shopping experiences. Features like virtual try-ons and personalized recommendations enhance customer engagement through intuitive apps.

Their frequent promotions, flash sales, and loyalty programs have gamified the shopping experience, driving repeated engagement and impulse purchases. This approach has turned the storefront into an interactive space, keeping customers hooked with constant offers and rewards. However, this strategy raises concerns about overconsumption and customer retention in the long term, as impulse buying may not translate into lasting brand loyalty.

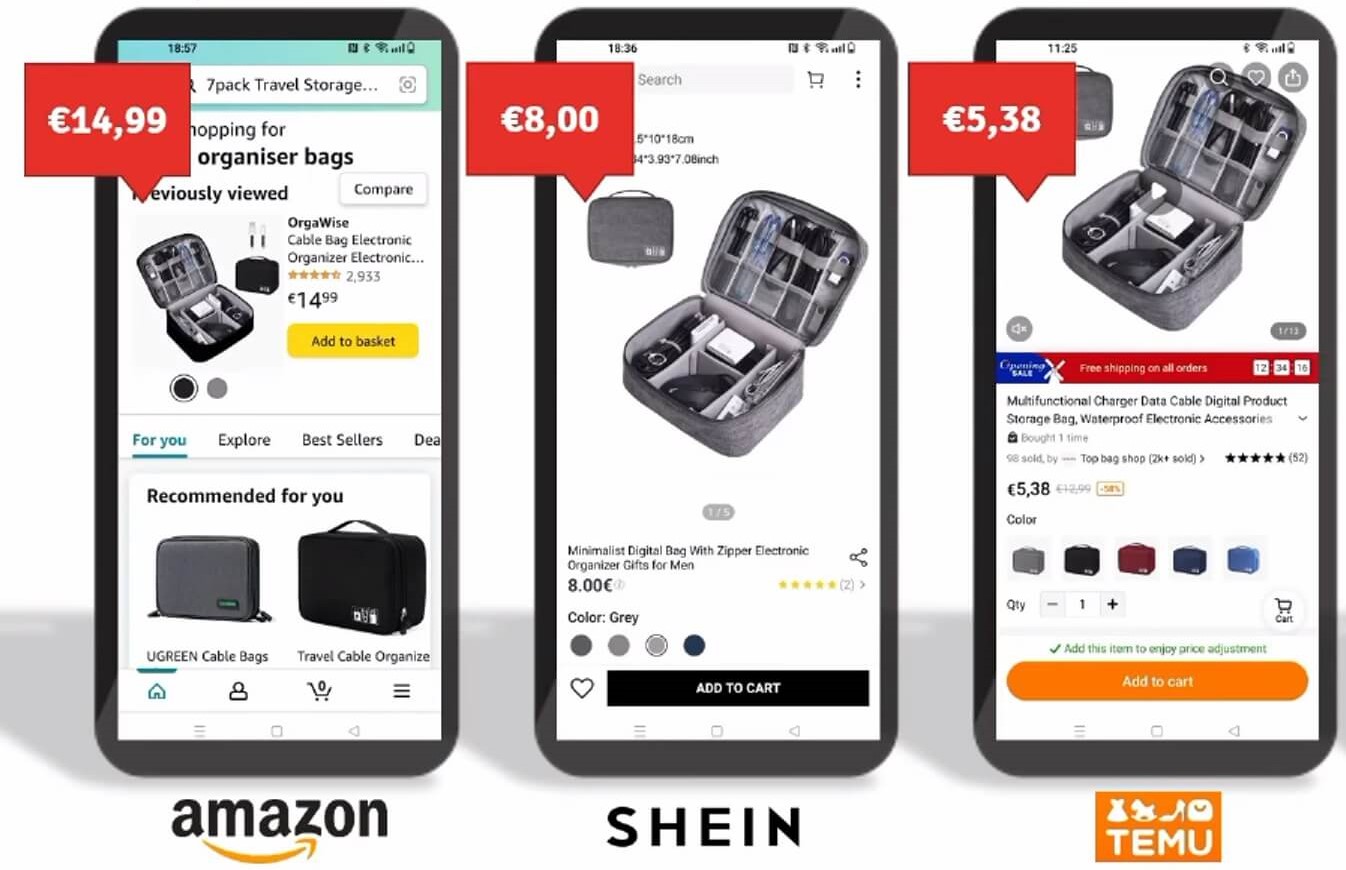

Competitive Pricing

The one big advantage Temu and Shein have over Amazon in its current state cannot be denied: lower prices. As shown in the following example, the exact same item on all three platforms might cost up to 70% more on Amazon, which could be fatal for the company as more consumers shift towards shopping by price.

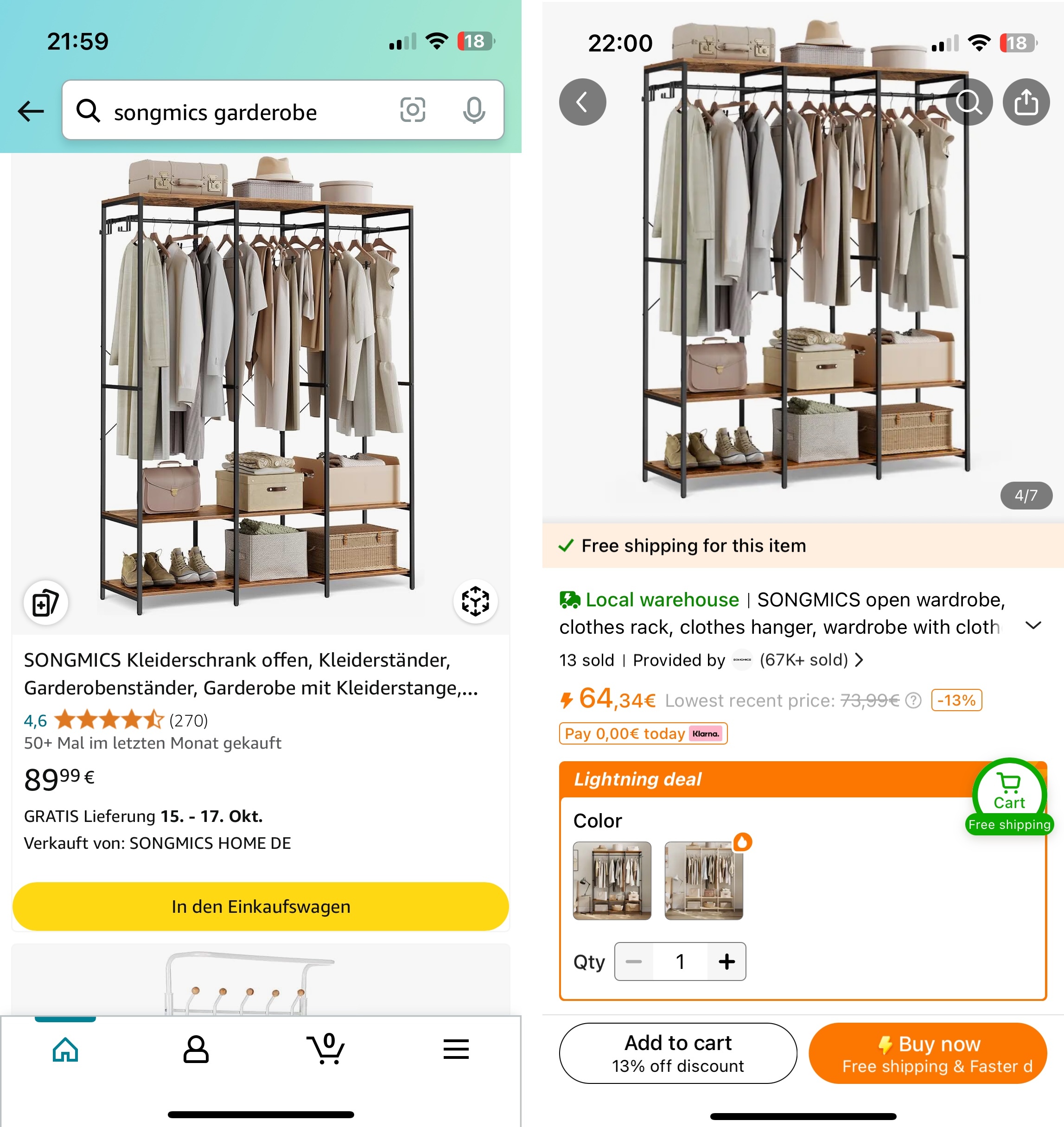

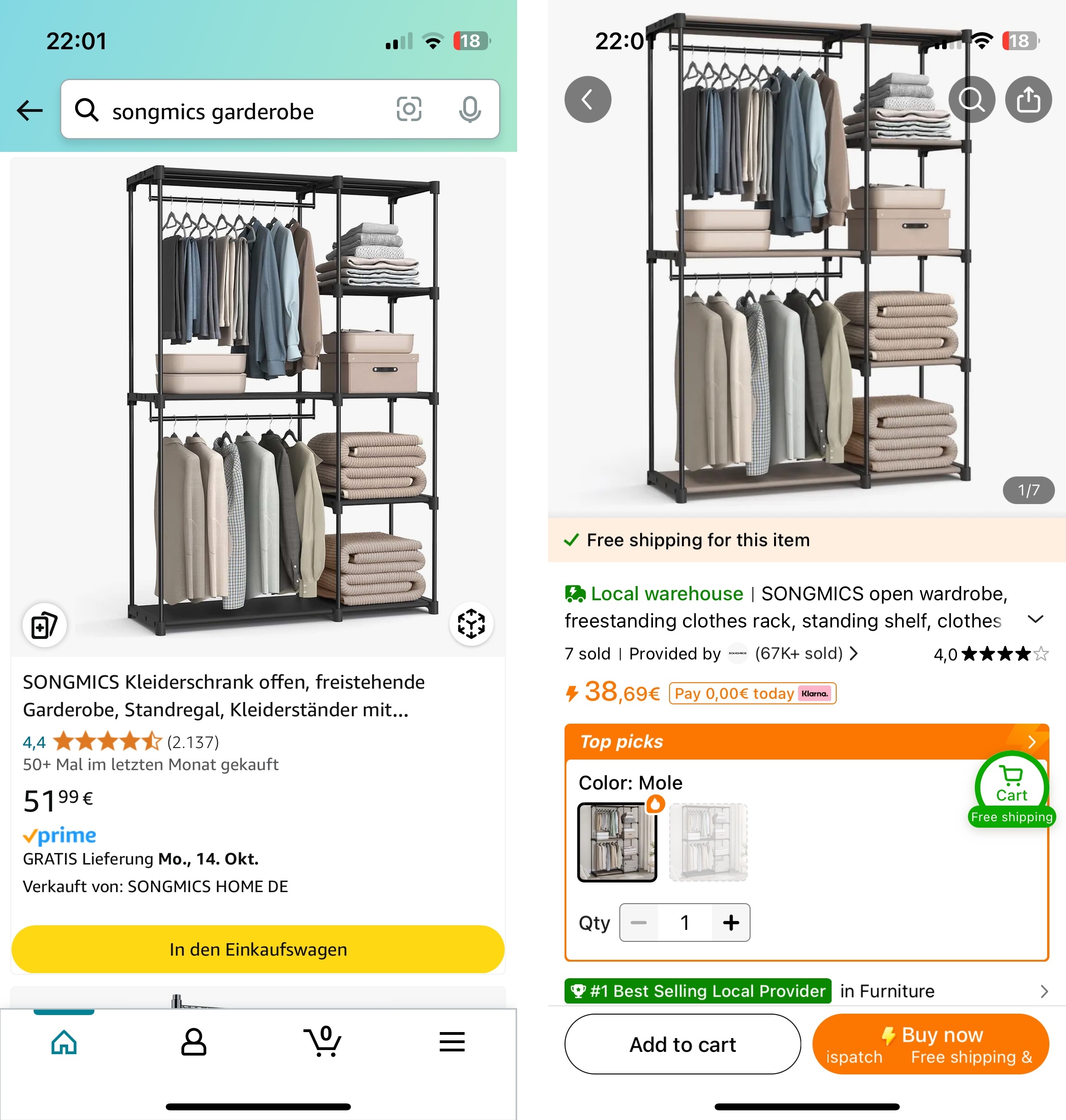

Products from SONGMICS for example can be found on both Amazon and Temu with identical pictures and product descriptions.

What is left for the consumer to decide on is therefore price, which is an easy choice as Temu offers these SONGMICS wardrobes for around 40% cheaper.

Direct-from-China Shipping

Their incredibly low prices stem from innovative business models that streamline operations and reduce costs.

Temu operates a consignment model, where manufacturers send products to their warehouses in China without Temu purchasing them upfront. Temu acts much like a reseller but without owning the products. Unsold products are returned to the factory, allowing Temu to minimize financial risk while offering a wide range of goods.

Shein focuses more on the initial phase of production, using a just-in-time model that starts with small batches and adds stock as demand grows. This helps them avoid overproduction, naturally reducing inventory and product waste.

These strategies enable both companies to keep their costs down, offering consumers lower prices without sacrificing product variety.

Amazon Haul: A Strategic Response

Amazon’s new low-cost section will introduce a curated range of products priced predominantly under $20, with many items available between $1 to $10. This pricing strategy targets young trend-driven individuals and budget-conscious families who have been flocking to platforms like Temu and Shein for their everyday needs and indulging in impulse purchases.

The process really took shape this summer when the company began signing up merchants after presenting the arrangement as a cost-saving opportunity for Amazon sellers in China. Product acceptance began in the fall, and by mid-November, the beta version launched in the US.

Product Categories

The product categories featured in Amazon Haul mirror those popularized by Temu and Shein, with a focus on unbranded, affordable items like:

- Fashion accessories and jewelry

- Home decor and small furnishings

- Beauty and personal care products

- Electronics accessories

- Kitchenware and gadgets

- Seasonal items and gifts

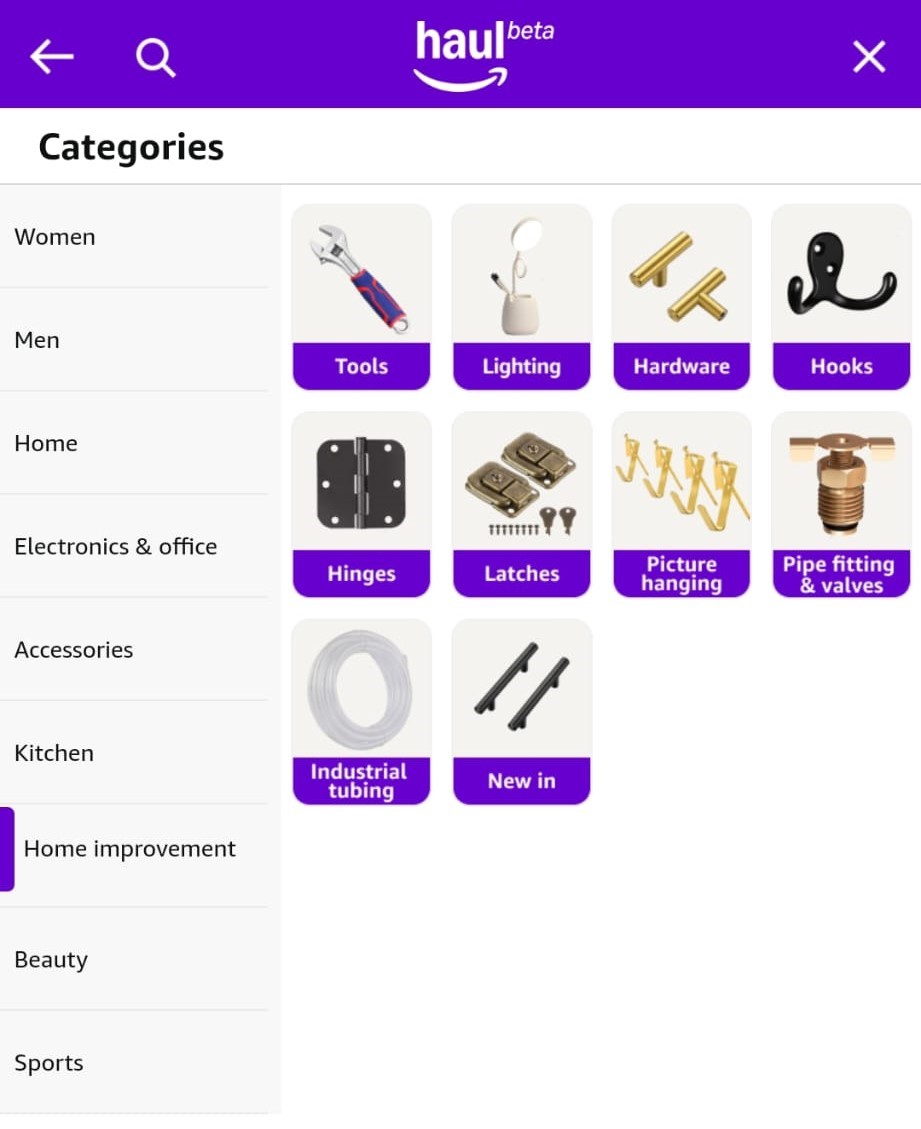

Here are the categories displayed in the beta version:

Pricing will be tightly controlled for each of the very specific product types, like toothbrush holders for example capped at $7. But overall, no item will be listed that is priced above $20. By prioritizing cheap everyday essentials, Amazon appears to be positioning itself to become a leading destination for budget-conscious shoppers.

Integration of Direct-from-China Shipping

Amazon’s budget-friendly storefront incorporates Direct-from-China shipping, aligning itself more closely with competitors like Temu and Shein. This marks a shift in Amazon’s approach, moving from supply chain integration at the destination to integration at the source. Amazon Haul relies on Amazon’s Chinese warehouses, allowing sellers to ship directly from manufacturers to US customers, which keeps prices low and avoids tariffs under the de minimis threshold.

Amazon may need this edge, as Temu and Shein also benefit from the US de minimis provision, which exempts packages under $800 from customs duties. However, upcoming reforms from the Biden-Harris administration may tighten regulations on these shipments, potentially impacting costs.

The addition of Direct-from-China shipping expands upon Amazon’s fulfillment network (FBA). Traditionally, products are sent via ocean freight to US FBA warehouses, where they sit until ordered by customers. Now, Chinese sellers can send products to Amazon’s Chinese warehouses, from where orders are air-freighted to the US in one to two weeks, allowing them to bypass expensive inventory fees.

Both Temu and Shein drastically lower their operational costs through similar models, but neither can match Amazon’s shipping times still.

| Platform | Shipping Method | Warehousing Model | Estimated Delivery Time (Standard) |

|---|---|---|---|

| Amazon Haul | Direct-from-China | FBA + China Direct Fulfillment | 1-2 weeks |

| Temu | Consignment Model | Integrated with Manufacturers | 7-15 days |

| Shein | Just-in-Time Production | Integrated with Manufacturers | 7-21 days |

The FBA network previously gave sellers a big competitive advantage by providing ultra-fast, one-to-two-day Prime shipping. However, as more customers prioritize price over delivery speed, they might switch to slower but cheaper alternatives like Temu and Shein. In order to retain those customers and keep them within Amazon’s ecosystem, Amazon Haul must establish itself in the future as a viable low-cost option.

Differentiated Design

While Amazon Haul operates within the main Amazon ecosystem, it was expected to maintain a distinct visual identity, based on how it was presented to Chinese sellers.

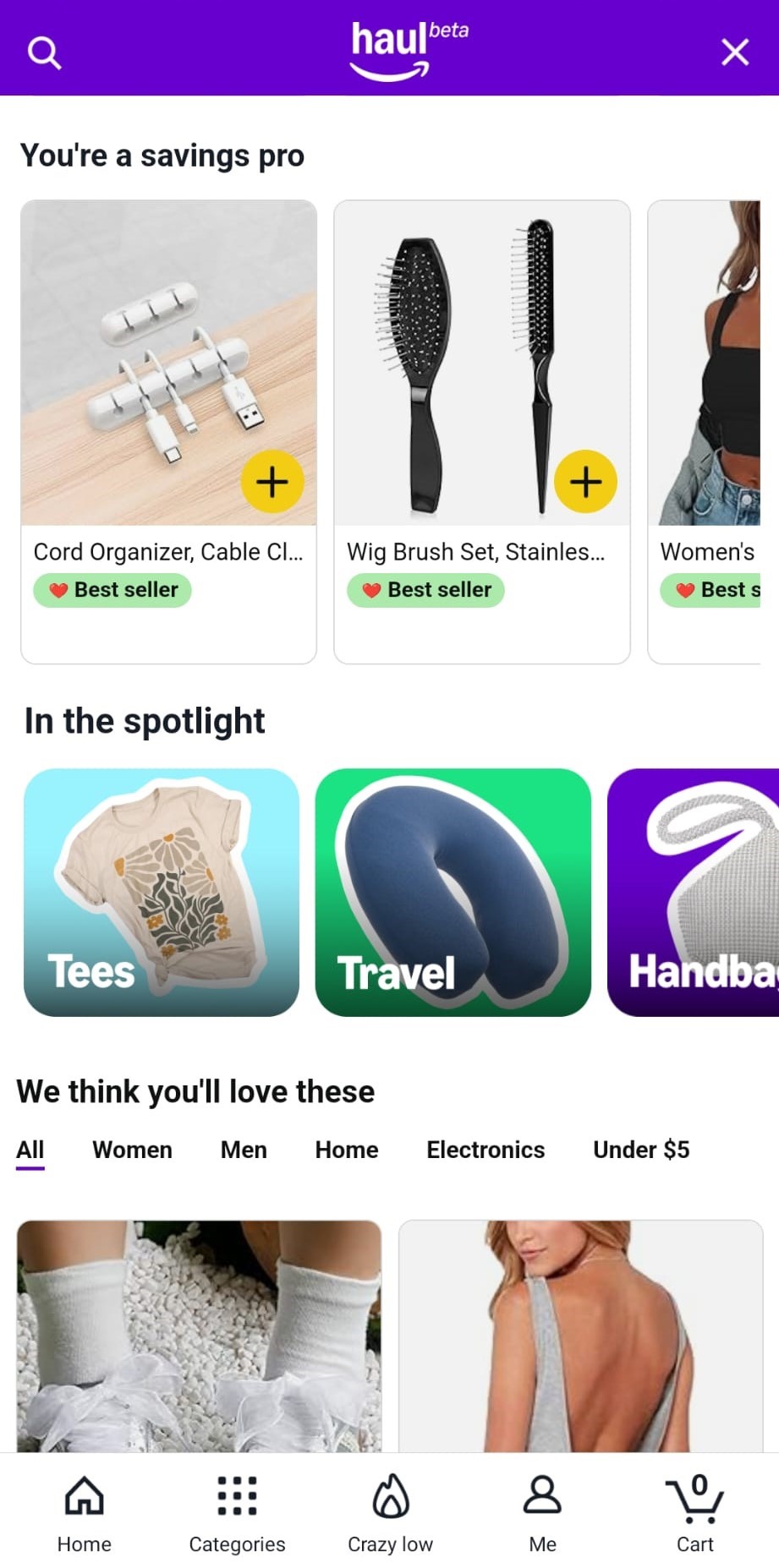

These predictions were confirmed by the beta launch. Amazon Haul is a mobile-only experience, accessible exclusively through the Amazon app. Unlike typical listings, Amazon Haul products aren’t accessible through Amazon’s general search. Users can find Amazon Haul by typing Haul in the search bar or scanning the QR code below.

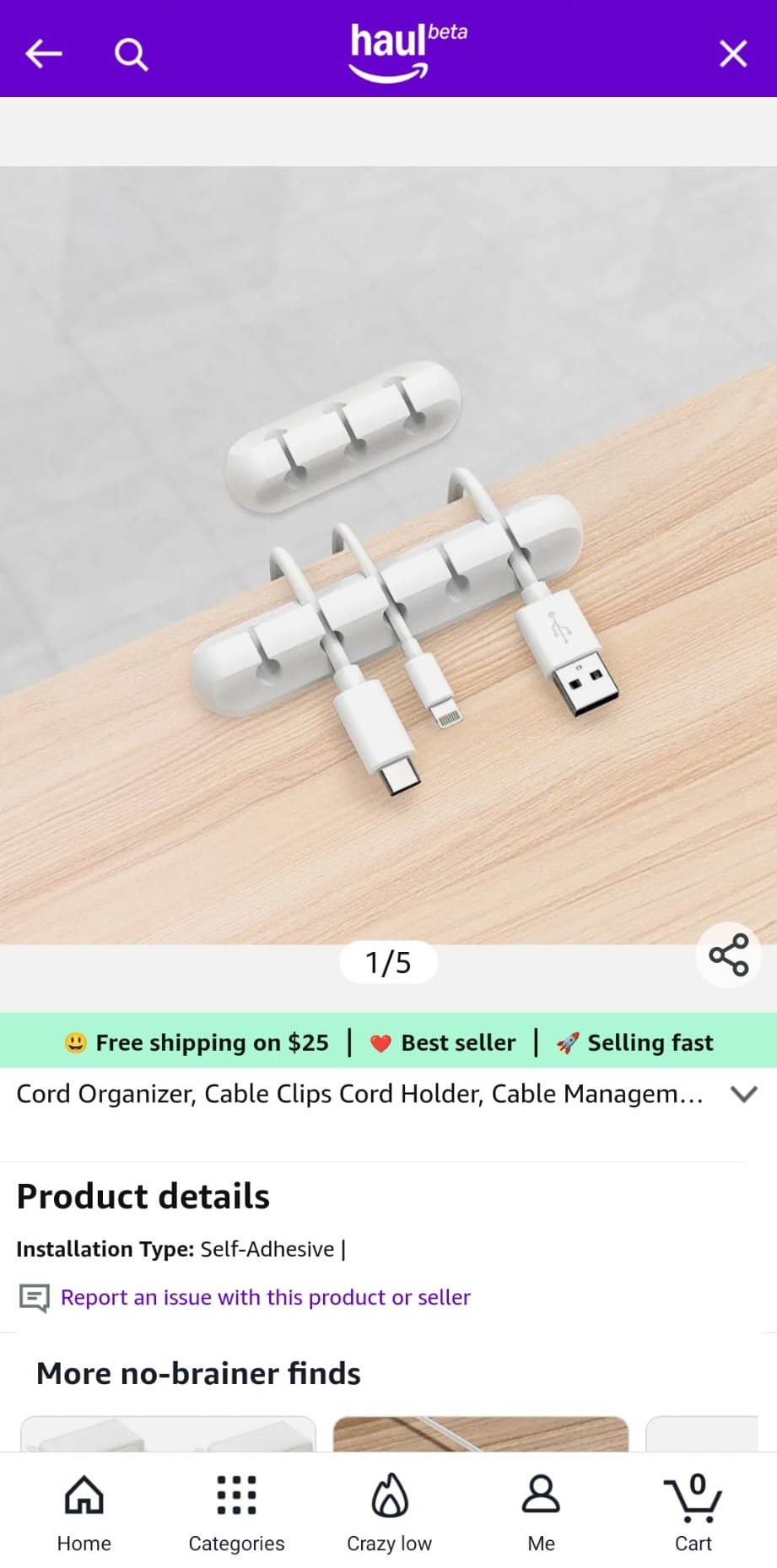

The app offers various item collections, such as You’re a Savings Pro for best sellers and In the Spotlight for more detailed categories. We think you’ll love these displays some of the official product categories, but also features an additional Under $5 section. When a product is selected, it appears as follows:

Amazon Haul visually sets itself apart from the main Amazon platform, while adopting a design style that resembles Temu and Shein. A flashing banner promoting sales adds to the familiar look.

The platform offers a 5% discount on orders over $50 and 10% on those above $75, with free shipping on orders over $25. Smaller purchases incur a $3.99 shipping fee. The return policy also differs from Amazon’s standard terms: items over $3 can be returned within 15 days for free, while items under $3 are final sale. These policies are designed to drive larger purchases, similar to its Chinese competitors.

Separating Amazon Haul so clearly allows Amazon to target price-sensitive consumers without diluting its broader brand image or alienating its existing customer base that may prioritize factors other than price.

Impact of Amazon Haul on Existing Vendors and Sellers

With the launch of its low-cost section, Amazon is introducing a new layer of competition that could reshape the way existing sellers and vendors operate within the marketplace. Amazon Haul directly challenges Temu and Shein, aiming to capture budget-conscious consumers through ultra-affordable pricing and a streamlined, mobile-first experience. Vendors and sellers now find themselves navigating a market where consumer expectations around cost, delivery, and product variety have shifted drastically.

Supply Chain Divide

The launch of Amazon Haul could put sellers and vendors all of a sudden in competition with their own suppliers.

Certain Chinese sellers and manufacturers will have the option for direct shipping on Amazon Haul. Other sellers, who typically purchase from these same manufacturers and store inventory in Amazon’s warehouses outside of China, face higher costs along the supply chain.

This divide will likely make it more difficult for non-Chinese sellers to compete with sellers who have more immediate access to their products. With shifting consumer demand and pricing pressures, managing inventory could also become more difficult for sellers trying to reduce costs, increasing the risk of over- or understocking.

Pressure on Margins

Algorithmic pricing is now the norm across major e-commerce platforms, which adjusts product prices in real-time to competitor prices, demand fluctuations, and inventory levels. This dynamic strategy will likely fuel pricing wars, especially if Amazon attempts to undercut Temu and Shein’s significantly lower prices.

As a result, vendors and sellers are under increasing pressure to lower their prices to maintain visibility. However, for many, cutting prices isn’t a viable option. Amazon Haul will exacerbate this issue, particularly for vendors offering products that overlap with those found on Temu, Shein, and now, Amazon Haul itself. In turn, it will greatly benefit Chinese sellers who can lower prices by shipping directly from their manufacturers. This places them in competition with smaller sellers who simply cannot match their pricing.

While this strategy could initially boost sales volume, the razor-thin margins typical of ultra-affordable products may limit profitability, posing a significant threat to resource-limited sellers.

Fees and Commissions

To mitigate the impact of these pricing pressures, Amazon could focus on generating income through higher fees and commissions. As of January, seller fees on clothing and accessories priced between $15 and $20 were already reduced from 17% to 10%, while fees for items under $15 dropped to 5%. Therefore it is likely that further adjustments to other product categories represented in Amazon Haul might follow.

Lower commissions may apply to products in the budget segment, while commissions for higher-priced items could slightly increase to compensate for revenue losses. These changes will require sellers to closely monitor their margins and adjust their offerings accordingly.

Key Points for Survival in Amazon’s Low-Cost Environment

It is important to recognize that many sellers have limited options when competing with the rise of low-cost products. While vendors can rely on the strength of their brands, most individual sellers don’t have that advantage.

To succeed in this evolving landscape, sellers must actively address these challenges. Below is a breakdown of the key strategies to strengthen and protect your business:

1. Product Differentiation

Offering a product selection that sets itself apart from Chinese sellers is key to standing out. Focusing on harder-to-transport items, like furniture, or targeting niche markets that Chinese platforms haven’t dominated yet, can give sellers a competitive edge.

Providing faster shipping is a significant advantage when selling products that customers need quickly. Expedited shipping for premium items not only meets the demand for convenience but also helps retain customers who value speed over cost.

Creating a unique brand identity ensures that shoppers seek your products specifically, even in a price-driven market. Through social media campaigns, sellers can strengthen their brand in ways that Chinese competitors can’t easily replicate.

2. Distribution Control

Vendors must safeguard their brands from unauthorized sellers offering their products on platforms like Temu and Shein at much lower prices. Strengthening control over distribution channels is essential to prevent this and maintain pricing strategies.

3. Lobbying

Vendors and sellers should advocate for policies that address practices like exploiting trade provisions (e.g., de minimis exemptions). By influencing such regulations, businesses can secure fairer conditions against Temu and Shein.

Actively monitoring regulatory developments in the US and Europe to stay ahead of changes that could impact pricing structures, taxation policies, and cross-border shipping practices.

By focusing on these strategies, sellers and vendors can better navigate the challenges of Amazon’s evolving marketplace and maintain their competitive edge.

Key Takeaways for Amazon Sellers

As Amazon introduces its new Amazon Haul, vendors and sellers face a transformed marketplace where ultra-competitive pricing is a key driver of consumer behavior. This shift, brought on by the rise of competitors like Temu and Shein, will especially challenge existing sellers to adapt to new pricing pressures and increased competition, especially from Chinese sellers benefiting from direct shipping options.

As Amazon redefines its ecosystem to meet the needs of budget-conscious shoppers, the future will be shaped by those who can evolve alongside these changes, ensuring that consumers, vendors and sellers find value in the new marketplace.

AMALYTIX’s Role in Supporting Sellers and Vendors

AMALYTIX, a tool designed to help vendors and sellers monitor performance, can be invaluable in navigating these changes. By tracking pricing trends, customer feedback, and competitive insights, AMALYTIX enables vendors and sellers to respond swiftly to marketplace shifts, optimize their product listings, and manage margins more effectively. In this evolving e-commerce landscape, vendors and sellers who leverage such tools to stay agile and customer-focused will be best positioned to thrive.

Subscribe to Newsletter

Get the latest Amazon tips and updates delivered to your inbox.

We respect your privacy. Unsubscribe anytime.